|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

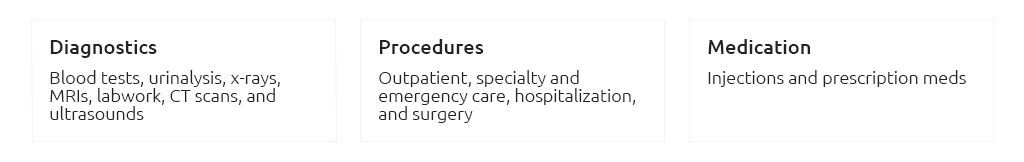

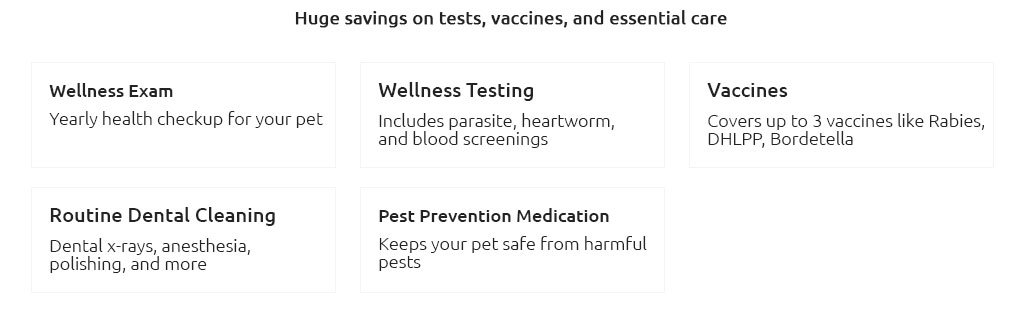

Pet Insurance Accepting Pre Existing Conditions: What to ExpectFinding pet insurance that accepts pre-existing conditions can be a challenge, but understanding your options can help you make an informed decision. While many policies exclude pre-existing conditions, there are some that may offer coverage. This article explores what to expect when seeking new pet insurance for your furry friends. Understanding Pre-Existing ConditionsA pre-existing condition is any illness or health issue that your pet has been diagnosed with or treated for before the start of a new insurance policy. Common examples include diabetes, arthritis, and allergies. Insurers typically exclude these conditions to minimize risk. Types of Coverage Available

Benefits of Insurance for Pre-Existing ConditionsEven if your pet has a pre-existing condition, obtaining insurance can be beneficial. Here are some reasons why:

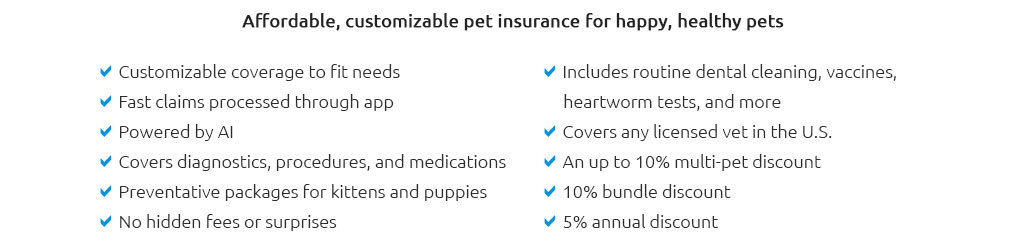

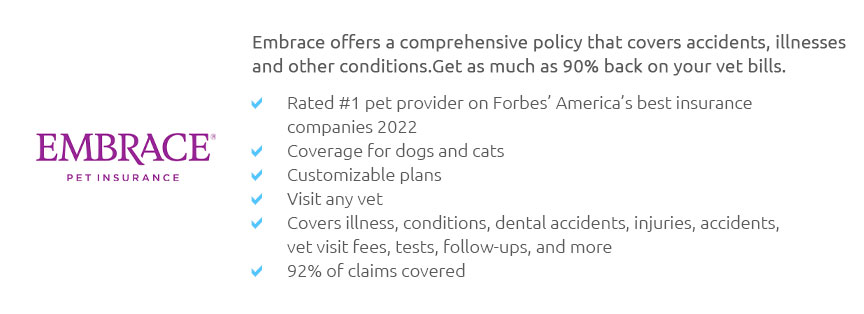

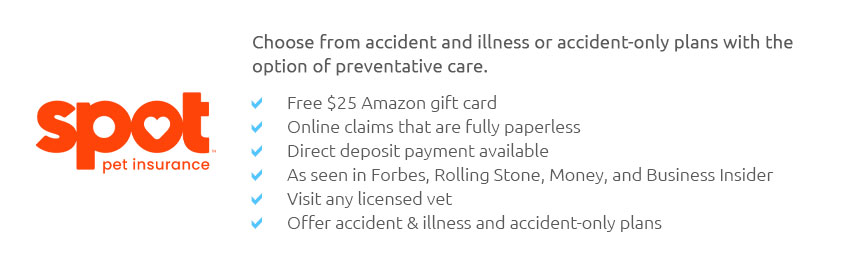

Choosing the Right PolicyWhen selecting a policy, consider your pet's specific needs and your budget. Research different providers and compare their offerings. You might find that one pet insurance plan better suits your situation than others. FAQ Sectionhttps://www.bankrate.com/insurance/pet-insurance/does-pet-insurance-cover-pre-existing-conditions/

Unfortunately, most pet insurance policies do not cover pre-existing conditions. If your pet has a medical issue before you purchase insurance, ... https://www.marketwatch.com/insurance-services/pet-insurance/best-pet-insurance-for-preexisting-conditions/

In most cases, pet insurance does not cover pre-existing conditions. Insurance companies see pets with these medical conditions as costly and ... https://money.com/best-pet-insurance-for-pre-existing-conditions/

The American Kennel Club (AKC) is the only pet insurance company that covers both curable and incurable pre-existing conditions. That means you ...

|